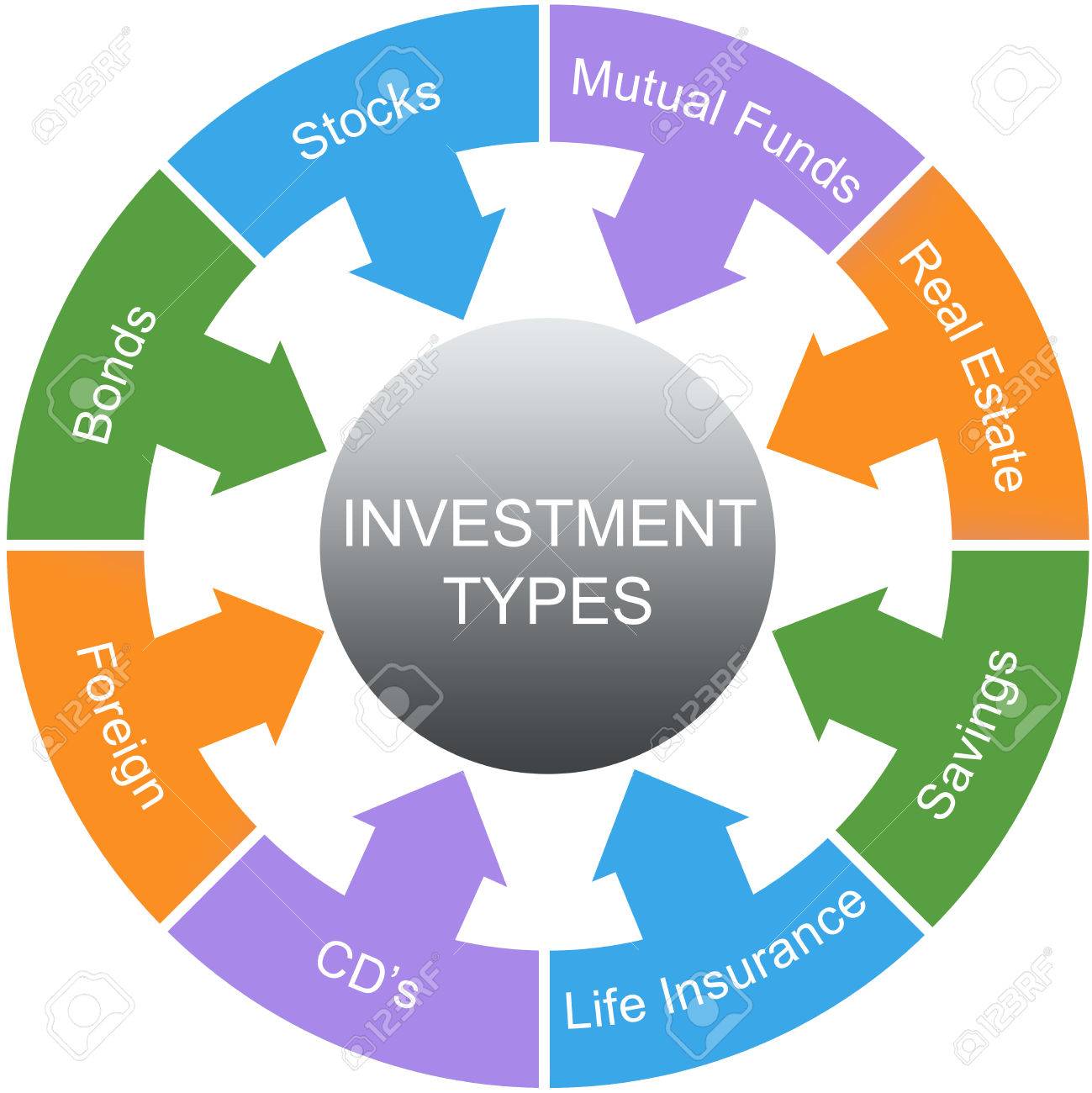

Types of Investments

Stocks.

When you purchase a stock, you are essentially buying a small piece of ownership in a particular company. The value of a company's stock is determined by the supply and demand for its shares in the stock market. The stock price can go up or down based on various factors such as the company's financial performance, market conditions, economic indicators, industry trends, and so on.

Investing in stocks can be risky as the stock prices can be volatile and unpredictable. There are several types of stocks, including common stocks and preferred stocks. Common stocks are the most common type of stock and represent ownership in a company. They typically offer voting rights to shareholders and can provide dividends as well. Preferred stocks, on the other hand, generally do not offer voting rights but offer fixed dividend payments that are paid out before any dividends on common stock.

Investing in stocks can be a good way to grow your wealth over the long term. Historically, the stock market has provided higher returns than other investments such as bonds or savings accounts. However, it is important to keep in mind that there are no guarantees in the stock market, and prices can fluctuate rapidly.

It is important for investors to do their research before investing in any particular stock. This may include analyzing the company's financial statements, reading analyst reports, monitoring industry trends, and considering macroeconomic factors that may impact the company's performance. It is also important to diversify your portfolio and avoid putting all your eggs in one basket by investing in a variety of stocks across different industries and sectors.

Bonds.

When you buy a bond, you are essentially lending money to a company or government entity. The issuer of the bond promises to pay you back the principal amount of the loan, also known as the face value or par value of the bond, at a specified date in the future, known as the maturity date. In addition to repaying the principal, the issuer will also pay you interest periodically until the bond matures.

The interest rate paid on a bond is typically fixed, although some bonds have variable interest rates that change over time. The interest payments are based on a percentage of the face value of the bond, known as the coupon rate. For example, if you own a bond with a face value of $1,000 and a coupon rate of 5%, you will receive $50 per year in interest payments.

Bonds are generally considered to be less risky than stocks, but they also offer lower potential returns. The creditworthiness of the issuer is an important factor to consider when investing in bonds, as companies or governments with a lower credit rating are more likely to default on their debt obligations.

Mutual funds.

A mutual fund is an investment vehicle that combines the money from a large group of investors to purchase a diversified portfolio of stocks, bonds, or other assets. Mutual funds are managed by professional money managers who use the pooled money to buy a variety of investments that align with the fund's investment objective.

When an investor buys shares in a mutual fund, they effectively own a portion of the underlying assets held by the fund. As the value of the assets in the fund rises or falls, so does the value of the investor's shares. Mutual funds provide investors with access to a broad range of investments that would be difficult or expensive to buy on their own.

There are many different types of mutual funds, each with its own investment objective and asset allocation strategy. For example, some mutual funds invest primarily in stocks, while others invest in bonds or other fixed-income securities. Some funds focus on specific sectors or industries, while others seek to provide a balance between different asset classes.

One of the advantages of investing in mutual funds is that they are generally considered to be a relatively low-cost way to invest in a diversified portfolio of assets. Mutual funds charge investors fees, such as expense ratios and management fees, but these costs are generally lower than the fees associated with buying and selling individual securities on your own. Additionally, mutual funds offer investors the convenience of having their investments professionally managed, which can help to reduce risk and increase returns over the long term.

However, it's important to note that mutual funds do come with risks, including the risk of loss of principal. Additionally, some funds charge higher fees than others, so it's important for investors to carefully evaluate the costs and potential returns of any mutual fund they are considering. Overall, mutual funds can be a useful tool for investors who want to build a diversified portfolio of investments without having to do all of the research and management themselves.

Index funds.

An index fund is a type of mutual fund that aims to track the performance of a specific stock market index, such as the S&P 500, the Dow Jones Industrial Average, or the Nasdaq Composite. The fund is designed to mirror the holdings and performance of the index, rather than actively managing a portfolio of individual stocks or other investments.

Index funds are considered a passive investment strategy, as they do not require the expertise of a professional portfolio manager to select investments. Instead, they hold a representative sample of the stocks or bonds included in the underlying index. This approach allows index funds to have lower fees than actively managed funds, as there is less need for ongoing research and analysis.

Investors can purchase shares in an index fund through a broker or financial advisor, and the value of those shares will rise or fall in accordance with the performance of the underlying index. For example, if the S&P 500 index rises by 5%, an S&P 500 index fund would be expected to rise by a similar amount (minus any expenses or fees).

One advantage of index funds is that they tend to be less volatile than actively managed funds, as they are diversified across a large number of securities. Additionally, index funds have historically performed well over the long term, as stock market indexes tend to rise over time.

Exchange-traded funds. (ETF)

Exchange-traded funds (ETFs) are similar to mutual funds in that they allow investors to own a diversified portfolio of stocks, bonds, or other assets in a single transaction. However, ETFs are different from mutual funds in the way they are bought and sold.

ETFs trade on an exchange like individual stocks, and their price changes throughout the trading day as investors buy and sell shares. This allows investors to buy and sell ETFs throughout the day at market-determined prices, which can be particularly useful for investors who want to make quick trades or react to market events.

ETFs can track a wide variety of indexes, such as the S&P 500 or a specific sector index like technology or energy. Some ETFs track indexes that invest in foreign stocks or bonds, providing investors with exposure to global markets.

Like mutual funds, ETFs can offer diversification benefits, allowing investors to own a basket of stocks or bonds across a wide range of industries and geographies. ETFs also tend to have lower expense ratios than actively managed mutual funds because they are passively managed, meaning they do not require a team of portfolio managers to make investment decisions.

Options. (High Risk. We do not recommend to our clients)

An option is a financial instrument that gives the holder the right, but not the obligation, to buy or sell a stock at a predetermined price (known as the strike price) on or before a certain date (known as the expiration date). When an investor buys an option, they are essentially purchasing a contract that gives them the right to buy or sell the underlying asset, in this case, a stock, at the agreed-upon price on or before the expiration date.

There are two types of options: call options and put options. A call option gives the holder the right to buy the underlying stock at the strike price, while a put option gives the holder the right to sell the underlying stock at the strike price.

Options contracts can be bought and sold just like stocks. Options trading can be used for a variety of purposes, including speculation, hedging, or generating income. Options trading can be complex, and it's important to have a good understanding of the risks involved before getting started.

Certificate of Deposit. (CD)

A certificate of deposit (CD) is a type of savings account offered by banks and credit unions that pays a higher interest rate than a traditional savings account in exchange for the account holder agreeing to leave the funds in the account for a set period of time, known as the term or maturity.

CDs typically offer a fixed interest rate for the entire term, which can range from a few months to several years. The longer the term, the higher the interest rate typically is. At the end of the term, the CD "matures" and the account holder can withdraw the funds and earned interest or renew the CD for another term.

The interest earned on a CD is generally higher than that of a savings account because the account holder is committing to keeping their money in the account for a specific period of time. This provides the bank or credit union with a guaranteed source of funds that they can use to lend to other customers, invest in securities, or use for other purposes.

One potential downside of CDs is that they typically have early withdrawal penalties if the account holder takes out their money before the end of the term. These penalties can vary depending on the institution and the specific CD, but they can often be significant enough to erase any interest earned on the account or even result in a loss of principal.

Overall, CDs can be a good option for those looking to earn a higher interest rate on their savings without taking on significant risk. However, it's important to carefully consider the terms and potential penalties before committing to a CD, as there may be better options available depending on the individual's financial goals and circumstances.

Real estate (We do not offer)

Real estate refers to a type of asset that is comprised of land, any buildings or other structures on that land, and any natural resources that may be present on the property, such as water or mineral deposits. Real estate can be either residential or commercial. Residential real estate refers to property used for housing, such as single-family homes, condominiums, and apartments. Commercial real estate, on the other hand, refers to property used for business purposes, such as office buildings, retail spaces, and warehouses.

Real estate is a tangible asset that can provide both income and capital appreciation to investors. Investors can generate income from real estate through renting out the property, and they can benefit from capital appreciation if the property increases in value over time.

Investing in real estate can be done directly by purchasing property outright or indirectly by investing in real estate investment trusts (REITs) or real estate mutual funds. Direct investment in real estate can be time-consuming and requires a significant amount of capital, whereas investing in REITs or mutual funds provides greater liquidity and diversification with lower minimum investment requirements.

Investment Advisory Firm Veteran Owned and Operated

Contact 253-948-6431 Invest@TaylorGoddard.comTempus Investment Corp is a registered investment adviser in the State of Washington and Oregon. The Adviser may not transact business in states where it is not appropriately registered, excluded or exempted from registration. Individualized responses to persons that involve either the effecting of transaction in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.