Strategy

Our Process.

Taylor Goddard Investments prides itself on its meticulous methodology for stock selection, which is firmly rooted in the analysis of both fundamental and technical data. Employing a judicious and measured perspective, we adopt a medium to long-term investment strategy when identifying equities with the potential to achieve doubling of value within a span of three to five years. It is imperative to acknowledge, however, that while we apply conservative strategies, the inherent volatility of investments necessitates a recognition of associated risks.Our conviction lies in the belief that financial well-being bestows a precious legacy upon you and your dear ones. Central to our mission is the assurance of your present and future fiscal preparedness. Our adept team is unswervingly committed to facilitating judicious decisions that harmonize with your financial aspirations, standing as a testament to durability. Entrust your investments to our expertise, and rest assured that they are under sagacious guardianship.

Open and effective communication constitutes the cornerstone of our approach. We ardently endeavor to apprehend the nuances of your objectives, timeline, and risk appetite, collaborating with you to devise an individualized roadmap that charts your triumph over these goals. Tailored to your distinct prerequisites, our investment management services stand as a bulwark for your perpetual economic security.

Investment Strategies:

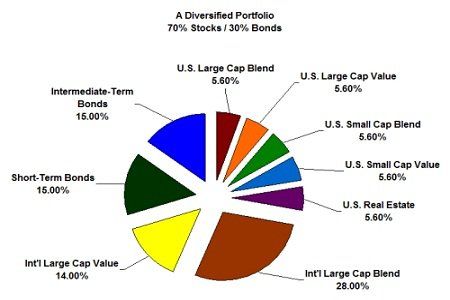

Within the realm of Taylor Goddard Investments, we present bespoke investment strategies meticulously crafted to align with the distinct requisites and aspirations of each client. Our focal point centers on the pursuit of sustained, long-term capital appreciation, a goal realized through a judicious dispersion of assets across diverse sectors. Ventures into short sales, options, or margin trading are infrequent occurrences, undertaken solely upon specific entreaty from our clients.Our investment portfolio predominantly comprises of exchange-listed securities, mutual funds, ETFs, corporate bonds, and CDs. Municipal and government bonds may also find their place, alongside guidance on variable and fixed annuities when deemed advantageous to a client's portfolio. Central to our ethos is a tenacious drive to curtail costs while maximizing gains on behalf of our esteemed clientele.

In collaborative consultation with our clients, we ascertain a harmonious apportionment between equities and fixed income, all the while remaining attuned to liquidity demands. Our foundation rests on the bedrock of diversification within portfolios, and we leverage a discerningly curated selection process to designate stocks for investment. Mutual funds, devoid of both load and transaction fees, constitute our preferred instrument for both equity and fixed income segments of portfolios.

In accordance with our investment paradigm, equities are retained for a minimum of one year, their early liquidation contemplated solely upon the achievement of predetermined sell benchmarks. Firmly rooted in the principles of tailored investment management and vigilant risk mitigation, our unwavering dedication revolves around steering our clients towards the actualization of their financial objectives.

Method of Analysis:

The analytical framework employed by our distinguished investment establishment commences with a meticulous screening process designed to unearth equities of robust financial standing. Following successful navigation through this financial filtration, our methodology embraces a computerized system to meticulously scrutinize the underpinnings of these selected stocks. Our scrutiny is directed towards identifying those equities that portray attributes of undervaluation, profitability, and robust growth potential. Our accomplished team of analysts harnesses a proprietary system of fundamental analysis, an amalgamation of diverse variables including earnings, revenue, cash flow, indebtedness levels, and more, to discern equities that hold the promise of market outperformance.Subsequent to the curation of a select portfolio meeting our rigorous criteria, we employ the tenets of technical analysis to ascertain the opportune timing for acquisition. This phase involves an incisive study of market trends, patterns, and indicators, culminating in the determination of propitious moments when a stock is poised for value appreciation. The harmonious synthesis of fundamental and technical analyses underscores our quest to identify premium equities, trading at compelling valuations, and endowed with the potential to yield robust returns over a protracted investment horizon. Our approach finds its moorings in a comprehensive comprehension of financial landscapes and a judiciously regimented investing ethos, thereby fortifying risk mitigation while optimizing returns.

Investment Advisory Firm Veteran Owned and Operated

Contact 253-948-6431 Invest@TaylorGoddard.comTempus Investment Corp is a registered investment adviser in the State of Washington and Oregon. The Adviser may not transact business in states where it is not appropriately registered, excluded or exempted from registration. Individualized responses to persons that involve either the effecting of transaction in securities, or the rendering of personalized investment advice for compensation, will not be made without registration or exemption.